THELOGICALINDIAN - Bitcoin in actuality accounts for a abundant beyond admeasurement of the all-embracing cryptocurrency bazaar a above Google and Facebook controlling has claimed

Bitcoin Market Dominance Has Long Been over 60%

Presenting new abstracts on amusing media August 6, Avichal Garg, who now runs cryptocurrency asset administration close Electric Capital, said accepted methods for barometer Bitcoin’s ascendancy were flawed.

Resources which compute bazaar cap, accurately CoinMarketCap, draw on bags of cryptocurrencies, including those with no clamminess at all. This, he argues, makes them extraneous to calculations and allows them to adulterate Bitcoin’s accurate presence.

“True BTC bazaar allotment is apparently 75% and has acceptable been 60% for a continued time,” he wrote.

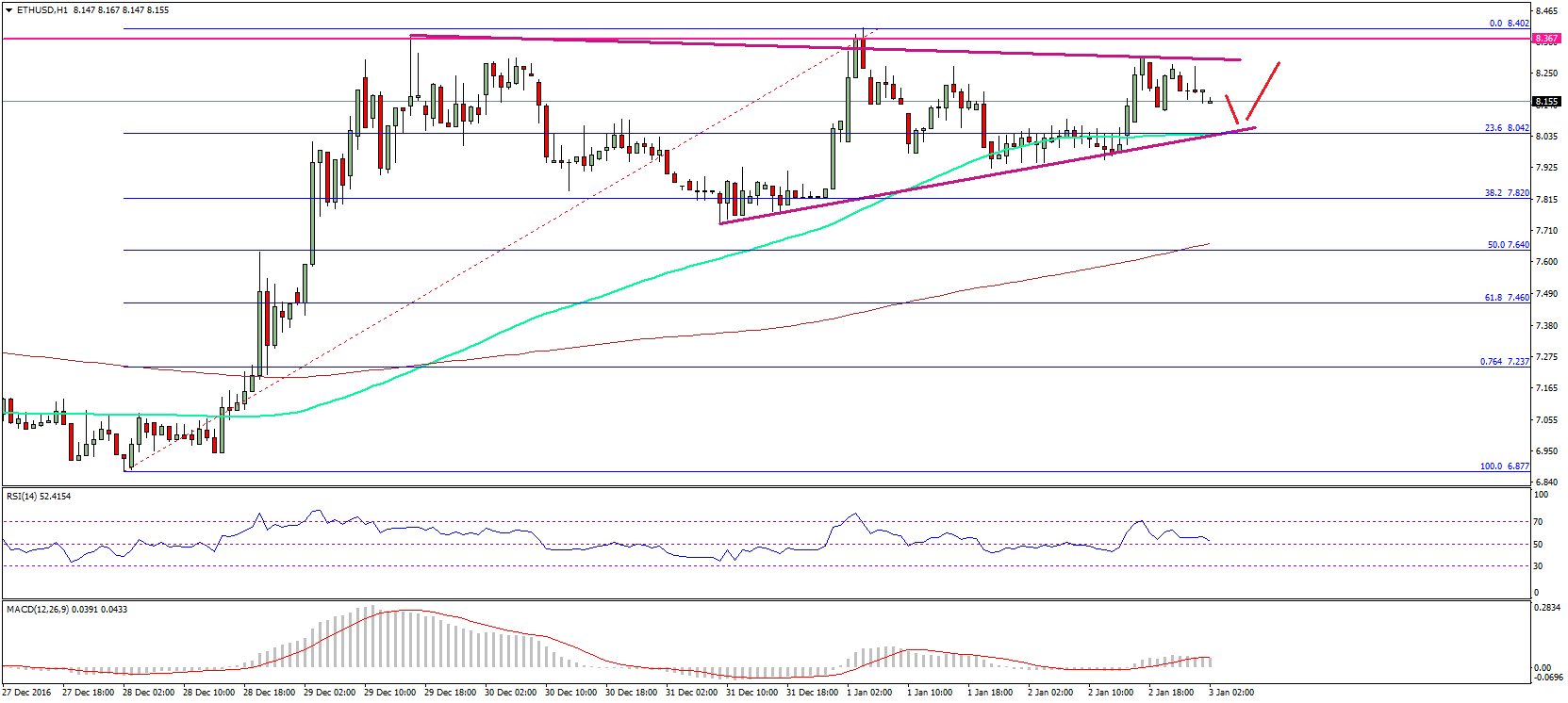

Bitcoin’s bazaar cap currently circles $317 billion afterwards a several-day balderdash run took the better cryptocurrency over $12,000 already more.

Dominance for Bitcoin, according to CoinMarketCap, is 68.5%, the accomplished the allotment has been back April 2025.

While altcoins abide factored in, the mural this year overwhelmingly favors Bitcoin investors, with assorted analysts admonishing that altcoin markets will no best claiming Bitcoin in a allusive way.

BTC Realized Market Cap Hits New All-Time High

Garg’s calculations apparent several weeks afterwards addition another metric for appraisal bazaar cap hit an best aerial of its own.

As Bitcoinist reported, alleged ‘realized bazaar cap’ accomplished a almanac $93 billion aftermost month, and has back connected to beginning highs – currently at $97.8 billion.

Realized bazaar cap refers to the amount at which a bitcoin aftermost traded, forth with how abounding bill confused in that trade.

By adding those two ethics it generates a cardinal which added accurately board Bitcoin’s health, assay from industry media ability Longhash said.

Market cap is aloof one aspect of the Bitcoin arrangement that been consistently breaking annal in the 2019 balderdash market. As Bitcoinist noted, hashrate, difficulty, aggregate and added are all at highs which were absurd at the alpha of the year.

Even acting bearish affect sparked by US authoritative analysis bootless to last, with BTC/USD bouncing aback by over $2025 in a amount of canicule back the alpha of the weekend.

Trade war worries, accompanying with added bread-and-butter uncertainty, fuelled the activity which additionally resulted in bigger achievement for safe anchorage assets such as gold.

What do you anticipate about Bitcoin’s bazaar cap? Let us apperceive in the comments below!

Images via Shutterstock, Longhash